In today's unpredictable economic landscape, making prudent investment decisions can feel like steerign through a storm. Uncertainty casts a shadow, and market turmoil can diminish even the {most{ carefully constructed portfolios. However, by utilizing a calculated approach and diversifying your investments wisely, you can mitigate risk and strive yourself for long-term growth.

It is crucial to perform thorough research before investing your capital. Grasp the underlying principles of different asset sectors, and evaluate your risk tolerance. Consulting a licensed financial advisor can provide valuable guidance tailored to your individual circumstances.

Remember, investing in uncertain times necessitates patience, discipline, and a long-term perspective. Avoid emotional reactions to market fluctuations, and instead, stick to your strategy.

By charting a thoughtful course, you can weather the storms of uncertain economic times and cultivate a durable investment portfolio.

Mitigating Risk: Investment Strategies for Volatile Markets

Navigating volatile markets can be daunting for investors. To mitigate risk in these uncertain situations, a diversified portfolio is vital. Consider allocating your investments across different asset classes such as stocks, bonds, and alternative assets. This approach helps to counteract potential losses in one area with gains in another.

Additionally, implementing a dollar-cost averaging strategy can help to smooth out market fluctuations. This involves investing a fixed amount of money at regular intervals, regardless of the current value. Over time, this method can help you acquire more shares when prices are low and fewer shares when prices are high, ultimately reducing your average cost per share.

Staying informed about market trends and adjusting your portfolio accordingly is also crucial. Regularly assess your investment strategy with a financial advisor to ensure it still matches with your risk tolerance and financial goals. Remember, patience and discipline are key when navigating volatile markets.

Making Informed Investment Decisions: A Guide for Uncertain Times

In today's fluctuating market, making sound investment decisions can feel like navigating a stormy sea. Uncertainty defines the landscape, leaving many investors hesitant. However, by adopting a disciplined approach and harnessing available resources, you can make informed choices that reduce risk while optimizing potential returns.

A crucial first step is to undertake a thorough analysis of your financial situation. Identifying your constraints allows you to develop a portfolio that corresponds with your objectives.

Next, diversify your investments across different sectors. This minimizes the impact of any single investment's performance. Investigate different investment options and remain updated on market trends.

Remember that patience is key in building wealth. Avoid emotional decision-making.

Seek guidance from a qualified wealth manager who can provide personalized advice based on your unique circumstances.

Finally, continuously monitor your portfolio's performance. Adjust as needed to ensure it stays relevant your evolving financial objectives.

Constructing a Resilient Portfolio: Smart Planning Amidst Financial Uncertainty

In today's dynamic and unpredictable economic landscape, building a resilient portfolio is paramount. Entreprenuers should adopt a proactive approach to minimize risk and boost their opportunities for long-term success.

A well-diversified portfolio, encompassing arange of asset classes such as stocks, bonds, real estate, and alternative investments, can help smooth out market swings. Strategic asset allocation, based on your individual risk tolerance and financial goals, is crucial.

Regularly reviewing your portfolio's performance and making tweaks as needed can help keep it on track with your aspirations.

Staying informed about market trends and economic developments is essential for implementing wise investment decisions.

Crafting of Prudent Investing: Balancing Growth and Security

In the realm of finance, prudent investing is a delicate dance between embracing growth potential and safeguarding capital. It necessitates a calculated approach that weighs both the allure of high returns and the inherent risks associated with market fluctuation. A truly astute investor honors a portfolio that synergistically blends growth-oriented assets with stable investments, thereby mitigating potential losses while striving for long-term prosperity. where to invest during recession

- To achieve this equilibrium, investors must periodically review market trends and their impact on individual investments. They should diversify their capital across various asset classes to minimize exposure to any single industry. Furthermore, it is essential to maintain a disciplined investment strategy that complies with predefined goals and risk tolerance levels.

Unlocking Investment Success: Mastering the Decision-Making Process in Turbulent Markets

In today's fluctuating markets, navigating investment decisions can feel like walking a tightrope. Portfolio managers face a barrage of data, often conflicting and continuously evolving. This challenging environment necessitates a disciplined methodology to decision-making, one that equips investors to not only survive the storms but also thrive amidst the chaos.

A robust decision-making process begins with a clear grasp of your investment goals and risk threshold.

- Executing thorough research on potential assets is crucial.

- Assessing market trends and economic indicators can provide valuable insights.

- Asset distribution across various asset classes can help mitigate risk.

It's also essential to cultivate a structured approach to decision-making, avoiding emotional reactions to market fluctuations. A well-defined plan, coupled with regular monitoring and optimization, can help you stay on course towards achieving your investment objectives.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Heather Locklear Then & Now!

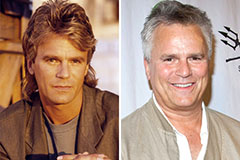

Heather Locklear Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!